OldCooper

Member

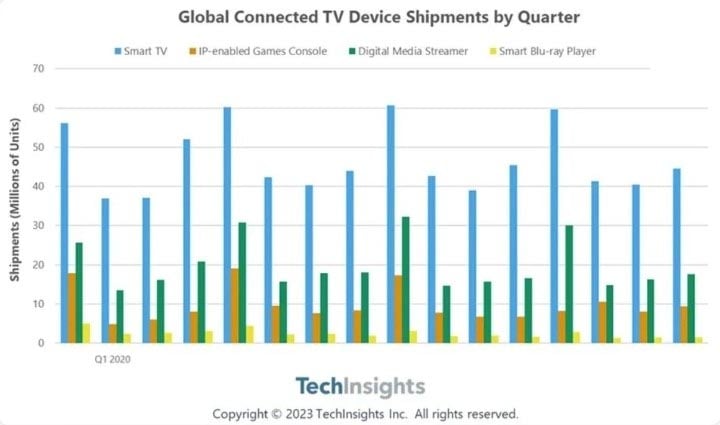

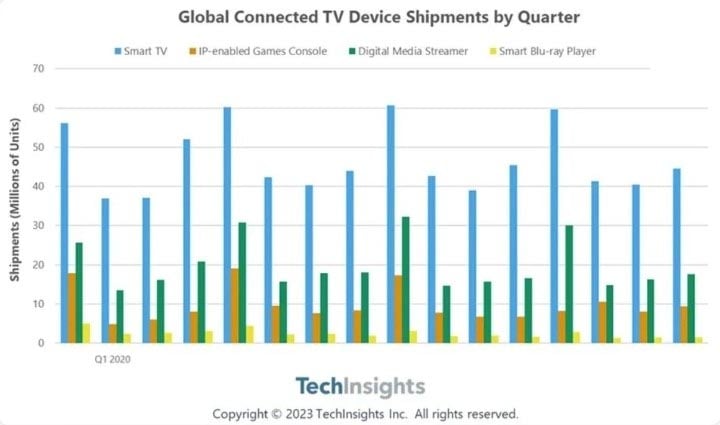

According to the latest research report from TechInsights, the global shipments of TV streaming devices increased by 3.5% year-on-year in Q3 2023. Smart TVs accounted for 70% of global TV streaming devices, digital media streamers made up 16%, and gaming consoles constituted 14%.

It is reported that the global shipment of Smart TVs slightly declined by 2% year-on-year in Q3, reaching just over 44.5 million units. Samsung holds the title as the world's largest smart TV brand with a market share of 20%, followed by LG and TCL, both at 11%. Amazon leads as the largest digital media streaming device brand, capturing a 40% market share, followed by Roku (20%), Apple (18%), and Google (15%).

TechInsights analysis suggests that in most parts of the world, rising inflation is squeezing consumers' discretionary spending, causing potential TV buyers to prioritize spending in other areas. The increased cost of living has also shifted purchasing behavior towards more affordable brands, restraining the growth of advanced display Smart TVs, such as OLED.

In the realm of Digital Media Streamers, the global shipments of standalone streaming devices increased by 4% year-on-year in Q3 2023, reaching 17.6 million. This market peaked in 2021, and as the ownership of smart TVs continues to rise, more people are using smart TVs as their primary access devices.

As for Game Consoles, driven by the ongoing popularity of the PS5 and the successful re-release of Nintendo's Zelda game, global shipments of gaming consoles grew by 11% year-on-year in Q3, reaching 9.4 million units. Sony, with a 39.2% market share, narrowly surpassed Nintendo (39.0%) in Q3 2023, becoming the world's largest gaming console brand.

It is reported that the global shipment of Smart TVs slightly declined by 2% year-on-year in Q3, reaching just over 44.5 million units. Samsung holds the title as the world's largest smart TV brand with a market share of 20%, followed by LG and TCL, both at 11%. Amazon leads as the largest digital media streaming device brand, capturing a 40% market share, followed by Roku (20%), Apple (18%), and Google (15%).

TechInsights analysis suggests that in most parts of the world, rising inflation is squeezing consumers' discretionary spending, causing potential TV buyers to prioritize spending in other areas. The increased cost of living has also shifted purchasing behavior towards more affordable brands, restraining the growth of advanced display Smart TVs, such as OLED.

In the realm of Digital Media Streamers, the global shipments of standalone streaming devices increased by 4% year-on-year in Q3 2023, reaching 17.6 million. This market peaked in 2021, and as the ownership of smart TVs continues to rise, more people are using smart TVs as their primary access devices.

As for Game Consoles, driven by the ongoing popularity of the PS5 and the successful re-release of Nintendo's Zelda game, global shipments of gaming consoles grew by 11% year-on-year in Q3, reaching 9.4 million units. Sony, with a 39.2% market share, narrowly surpassed Nintendo (39.0%) in Q3 2023, becoming the world's largest gaming console brand.