Catalogs Hide

Recently, China Video Industry Association and RUNTO jointly released the "2022 Global Laser Display Industry Chain Development and National Regional Competitiveness White Paper". This is another heavyweight study focusing on the upstream and downstream supply chain of the laser display industry and the evaluation of global regional competitiveness, following the release of the "2021 Laser Display Industry Development and User Experience Operation White Paper" in the previous year.

2022 was undoubtedly a difficult year, with great challenges for global economic development. In all walks of life, technological innovation is always the fundamental driving force to achieve breakthroughs in the downturn, and laser display, as another generation of display technology following black and white display, color display, and digital display, is becoming one of the important directions to create a high-end visual experience.

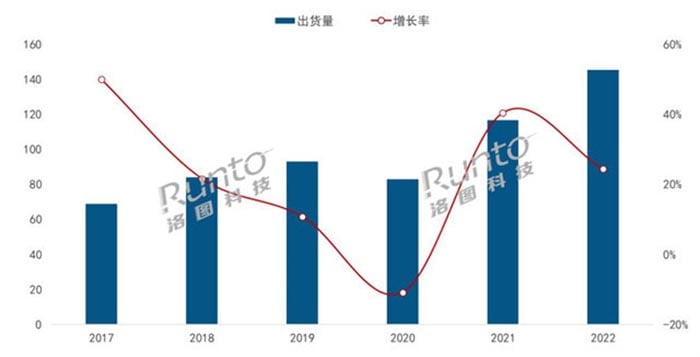

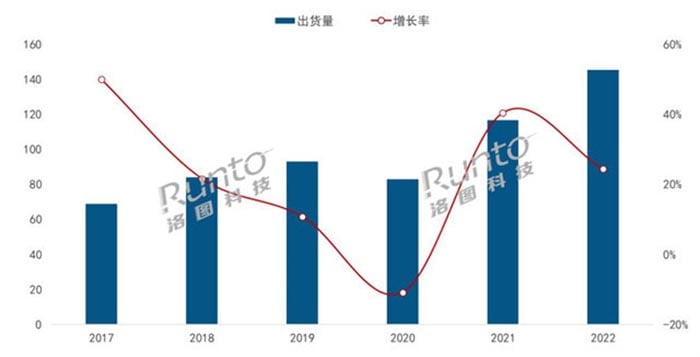

According to RUNTO, the global laser projection market will ship 1.45 million units in 2022, up 24% year-over-year.

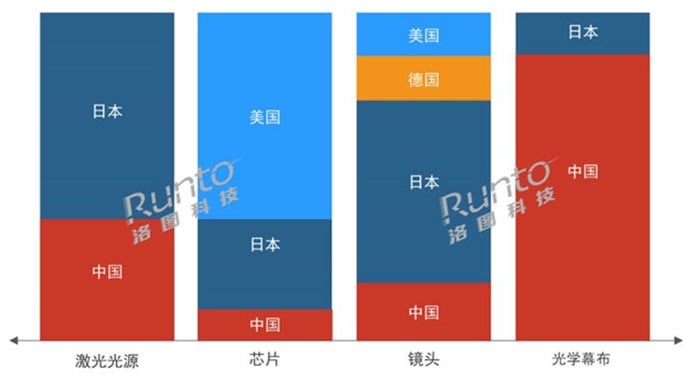

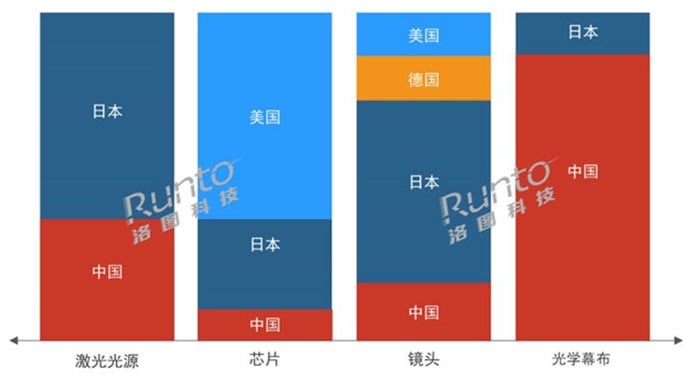

In the laser display supply chain, the United States, Germany, Japan, South Korea, and other countries have carried out layouts around the laser display light source, imaging chip, projection lens, and other core materials and devices, and even some of the key materials and devices are strangle.

The focus varies from country to country and region to region. By subdivision, Japanese companies have advantages in laser light sources, 3LCD technology and LCOS technology, optical lenses, and projector screens. The US is at the heart of the supply of DLP chips and has a technical presence in ultra-short focal lenses. Europe's strength is concentrated in optics, and Zeiss lenses and Leica cameras still represent the world's highest standards of optical design, processing, and manufacturing technology. Taiwan of China has the world's leading technology in encoding and decoding chips, occupies a huge market in laser projection, and is a hub for producing black-grid screens in optical screens.

Under the support of the Ministry of Science and Technology, the Ministry of Industry and Information Technology, and relevant government units, more and more enterprises and scientific research institutions in China are participating in the upstream and downstream areas of the laser display industry chain, focusing on technology research and development and iteration, strengthening the industrial chain, and further improving the localization rate of core components of products.

Laser display of the four core devices localization degree from high to low for anti-light curtain, laser light source, lens, and light imaging chip. Under the technological breakthrough, the degree of localization of the laser industry chain is expected to increase from 45-55% to 75%-80% in the next 3-5 years, realizing the leap from technology leadership to industry leadership.

In terms of complete machine manufacturing, Chinese companies have explored mature technology and experience and are in the absolute leading position globally. In terms of complete machine shipments, China is the world's largest consumer market for laser display products, occupying nearly half of the global market share.

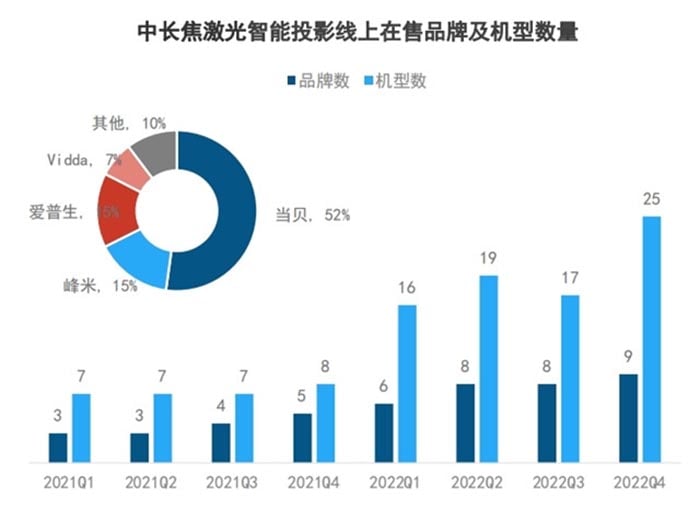

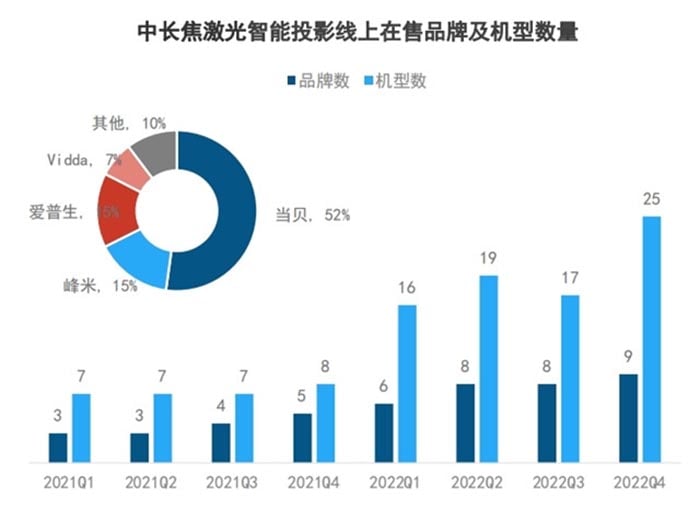

Data from RUNTO show that in 2022, the online sales of medium telephoto laser intelligent projection exceeded 140,000 units, with a year-on-year growth of 131%, more than double. In addition to the growth of the overall size of the market brought about by the expansion of consumer demand, the increasing number of participants and the increasing richness of product supply are also contributing factors to the rapid growth of the market. But from the brand pattern, the horse effect is still relatively obvious, small and medium-sized brands have not yet become a climate, in the field of a large screen with the advantage of the whole industry chain layout Dangbei occupies more than half of the laser intelligent projection market share, and still maintain a rapid growth trend.

In early 2023, the China Video Industry Association (CVIA), together with a number of leading companies, initiated the "Technical Requirements and Test Methods for Light Output of Projectors", referred to as the "CVIA Lumen Brightness Standard", which is the first group standard specifically for projector brightness in China. As the main initiator, Dangbei then took the lead in the product side to enable the "CVIA lumen brightness standard", which also implies that in the field of laser display, the head brand has established a moat in terms of core technology, and it is difficult for latecomers to surpass in the short term.

The purpose of the "2022 Global Laser Display Industry Chain Development and National Regional Competitiveness White Paper" is to further sort out the laser display supply chain capabilities and national regional competitiveness performance, promote the rapid realization of economies of scale of new display technologies, promote the improvement of the display industry chain and localization, and realize the high-quality development of the laser display industry.

2022 was undoubtedly a difficult year, with great challenges for global economic development. In all walks of life, technological innovation is always the fundamental driving force to achieve breakthroughs in the downturn, and laser display, as another generation of display technology following black and white display, color display, and digital display, is becoming one of the important directions to create a high-end visual experience.

According to RUNTO, the global laser projection market will ship 1.45 million units in 2022, up 24% year-over-year.

Laser display global regional competitiveness evaluation

In the laser display supply chain, the United States, Germany, Japan, South Korea, and other countries have carried out layouts around the laser display light source, imaging chip, projection lens, and other core materials and devices, and even some of the key materials and devices are strangle.

The focus varies from country to country and region to region. By subdivision, Japanese companies have advantages in laser light sources, 3LCD technology and LCOS technology, optical lenses, and projector screens. The US is at the heart of the supply of DLP chips and has a technical presence in ultra-short focal lenses. Europe's strength is concentrated in optics, and Zeiss lenses and Leica cameras still represent the world's highest standards of optical design, processing, and manufacturing technology. Taiwan of China has the world's leading technology in encoding and decoding chips, occupies a huge market in laser projection, and is a hub for producing black-grid screens in optical screens.

China's laser display supply chain localization is underway

Under the support of the Ministry of Science and Technology, the Ministry of Industry and Information Technology, and relevant government units, more and more enterprises and scientific research institutions in China are participating in the upstream and downstream areas of the laser display industry chain, focusing on technology research and development and iteration, strengthening the industrial chain, and further improving the localization rate of core components of products.

Laser display of the four core devices localization degree from high to low for anti-light curtain, laser light source, lens, and light imaging chip. Under the technological breakthrough, the degree of localization of the laser industry chain is expected to increase from 45-55% to 75%-80% in the next 3-5 years, realizing the leap from technology leadership to industry leadership.

In terms of complete machine manufacturing, Chinese companies have explored mature technology and experience and are in the absolute leading position globally. In terms of complete machine shipments, China is the world's largest consumer market for laser display products, occupying nearly half of the global market share.

Data from RUNTO show that in 2022, the online sales of medium telephoto laser intelligent projection exceeded 140,000 units, with a year-on-year growth of 131%, more than double. In addition to the growth of the overall size of the market brought about by the expansion of consumer demand, the increasing number of participants and the increasing richness of product supply are also contributing factors to the rapid growth of the market. But from the brand pattern, the horse effect is still relatively obvious, small and medium-sized brands have not yet become a climate, in the field of a large screen with the advantage of the whole industry chain layout Dangbei occupies more than half of the laser intelligent projection market share, and still maintain a rapid growth trend.

In early 2023, the China Video Industry Association (CVIA), together with a number of leading companies, initiated the "Technical Requirements and Test Methods for Light Output of Projectors", referred to as the "CVIA Lumen Brightness Standard", which is the first group standard specifically for projector brightness in China. As the main initiator, Dangbei then took the lead in the product side to enable the "CVIA lumen brightness standard", which also implies that in the field of laser display, the head brand has established a moat in terms of core technology, and it is difficult for latecomers to surpass in the short term.

The purpose of the "2022 Global Laser Display Industry Chain Development and National Regional Competitiveness White Paper" is to further sort out the laser display supply chain capabilities and national regional competitiveness performance, promote the rapid realization of economies of scale of new display technologies, promote the improvement of the display industry chain and localization, and realize the high-quality development of the laser display industry.